📄

Professional Trust Documents

Expertly drafted trust documentation customized for your specific ministry type and governance structure. All documents ensure full federal compliance and provide the legal foundation for your organization.

💻

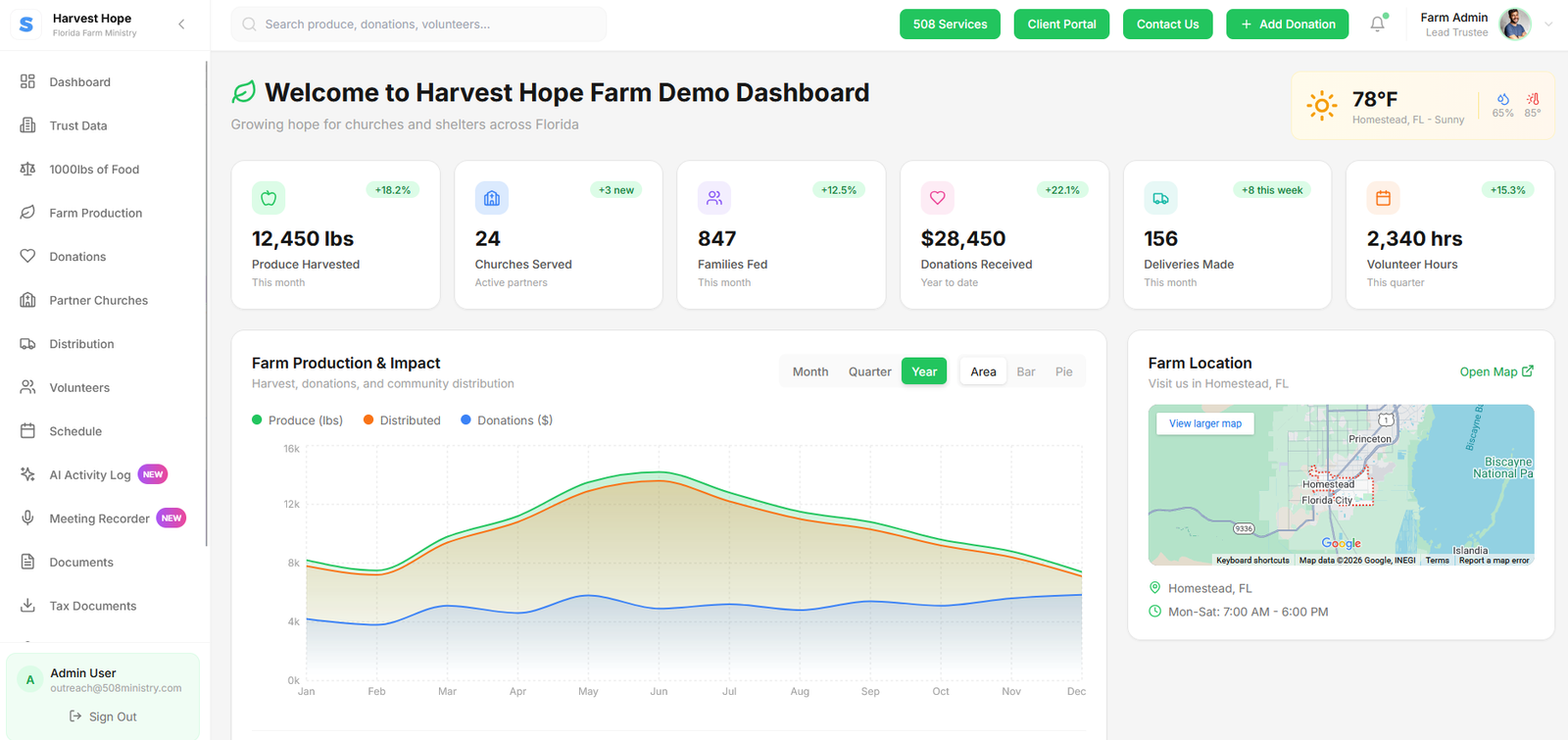

Ministry Management Dashboard

Lifetime access to our enterprise-grade management platform. Track donors, monitor contributions, generate reports, manage trustees, and oversee all ministry operations from one centralized interface.

💰

Donor Portal & Tracking

Empower supporters with secure portal access to view contribution history, download tax receipts, update information, schedule recurring donations, and track their impact throughout the year.

📊

Comprehensive Reporting System

Generate detailed reports including donor summaries, annual tax receipts, financial statements, compliance documentation, and custom analytics. Export data in multiple formats for accounting and record-keeping.

🌐

Complete Website Build-Out

Professional website design and deployment with content management system, secure hosting, SSL certificate, and full integration with your donor portal and management dashboard.

👥

Admin & Trustee Portal

Grant secure access to administrators, trustees, and staff with customizable permission levels. Enable collaborative ministry management while maintaining appropriate access controls and audit logging.

🗄️

Secure Database Infrastructure

Enterprise-grade cloud database with automatic daily backups, encryption at rest and in transit, role-based access controls, and compliance with industry-standard security protocols.

🎓

Training & Support

Comprehensive video tutorials, written documentation, live onboarding sessions, and ongoing technical support. Our team ensures your success with responsive assistance via email, phone, and live chat.